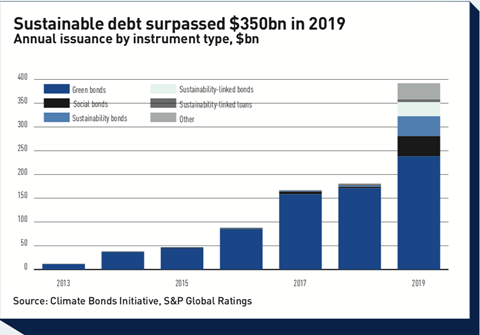

I n the space of barely a decade green bonds have gone from the periphery of the capital markets to being one of its fastest-growing segments. Breakdown of the top 15 largest issuing sectors of green social sustainability and sustainability-linked bonds in 2021 as of 7 May 2021.

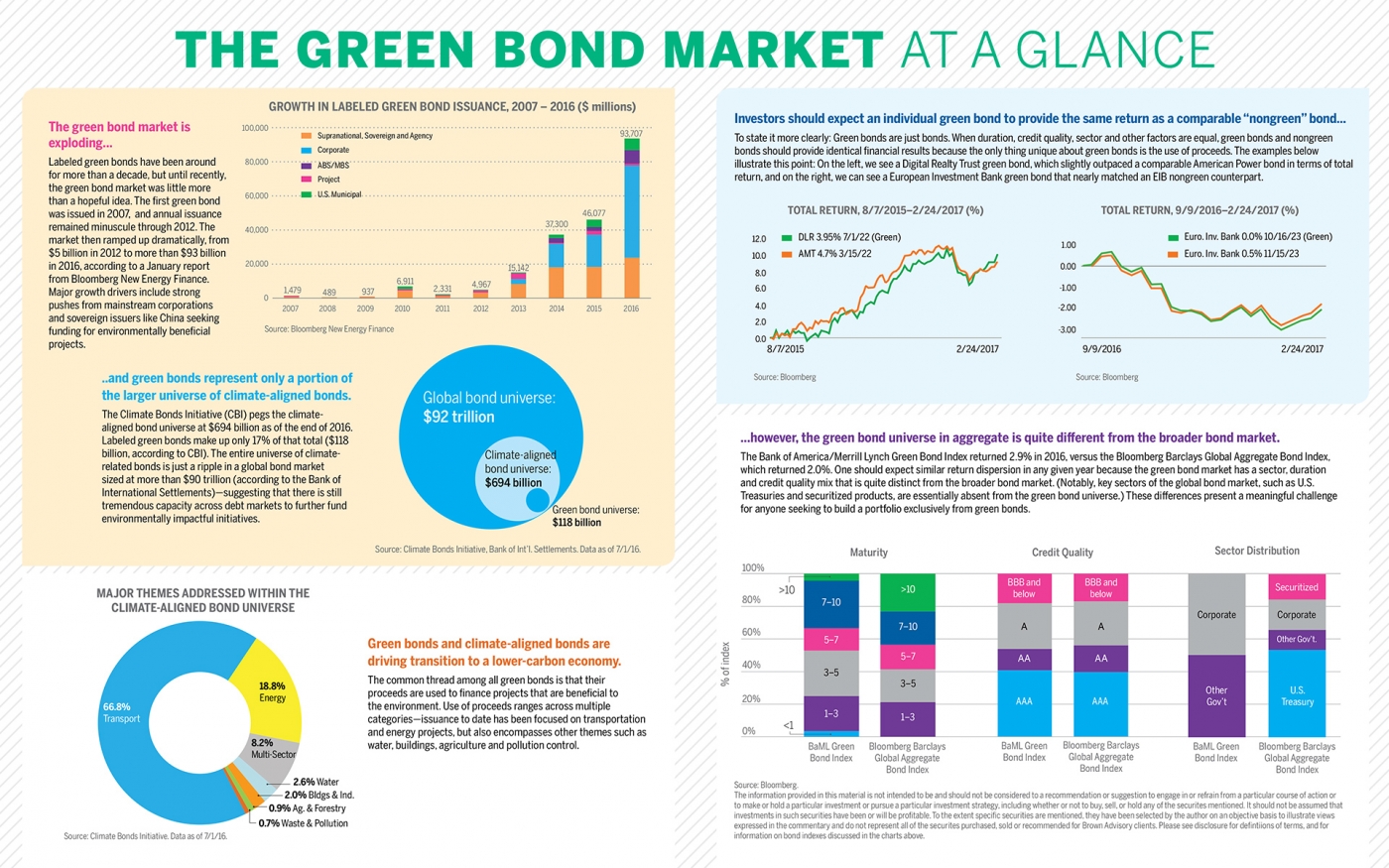

Income And Impact Adding Green Bonds To Investment Portfolios Brown Advisory

For the Barclays MSCI Green Bond Index securities are independently evaluated by MSCI.

Breakdown of green bonds by building sector. The Scheme is used globally by bond issuers governments investors and the financial markets to prioritise investments which genuinely contribute. Specifically debt obligations tied to investment activities targeting new and existing projects with environmental benefits across all industry sectors1. The enterprises Multifamily Green MBS program is used to finance green mortgages backed by multifamily properties that are awarded green building certifications or display audited efficiency improvements.

Climate bonds are a sub-category where the proceeds are linked to projects that address climate change. Fannie Mae was the largest green bond issuer in 2020 with a total issuance of USD13bn. Green bonds are fixed-income securities whose proceeds are meant to be allocated to sustainable assets.

Global number of climate-aligned bonds by sector 2020 Published by Statista Research Department May 5 2021 This statistic displays the number of climate-aligned bonds. GREEN BONDS 3 The worlds transition to a low-carbon economy necessitates a massive shift in the allocation of financial capital. Certified as green and unlabelled green bonds issuances linked to projects that produce environmental benefits.

Green bonds are fixed income securities in which the proceeds will be exclusively and formally applied to projects or activities that promote climate or other environmental sustainability purposes through their use of proceeds. With the support of more than 80 organisations the World Green Building Councils new report describes actions to revolutionise the buildings and construction sector towards a net zero future through elimination of embodied carbon emissions. Scott Freedman credit analyst and portfolio manager at Newton Investment Management said in the survey.

So far this year the financial sector has been dominant with nearly 45 of financial issuances being green bonds. The global breakdown for CO 2 is similar to that of total greenhouse gases electricity and heat production dominates followed by transport and manufacturing and construction. Two categories of green bonds have emerged ie.

Rigorous scientific criteria ensure that bonds and loans with Certification are consistent with the 2 degrees Celsius warming limit in the Paris Agreement. 23 September 2019 London UK - As part of the 10 th annual World Green Building Week the World Green Building Council WorldGBC has issued a. June 2013 first muni Green Bond was issued by Massachusetts October 2013 Gothenburg issues the first City Green Bond November 2013 SolarCitynow Tesla Energy issues the first solar ABS 2014ICMAestablishes its Green Bond Principles November 2014 Vasakronan a.

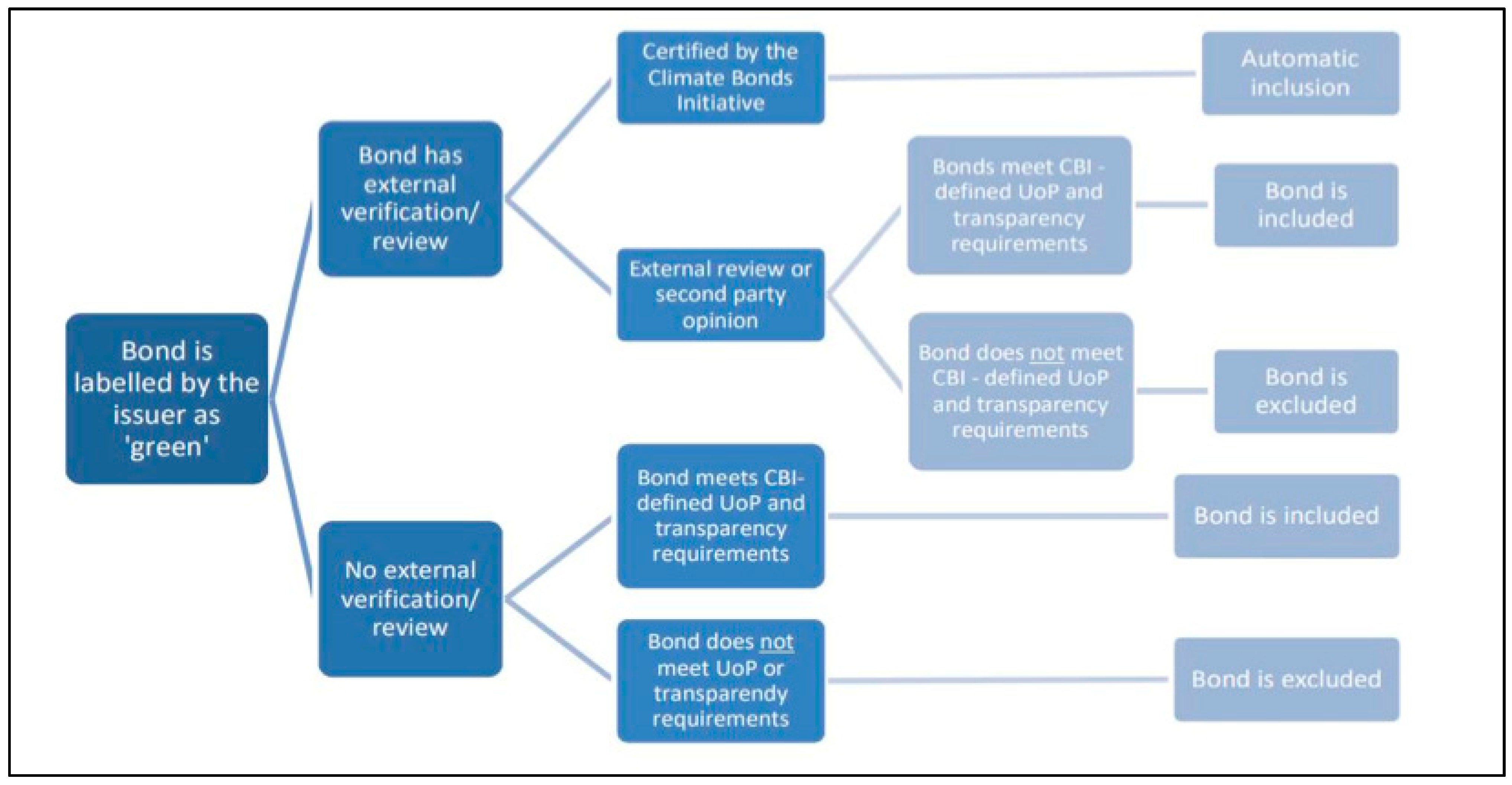

The Climate Bonds Standard and Certification Scheme is a labelling scheme for bonds and loans. Fiji last year issued the first emerging market sovereign green bond. In 2019 31 percent of proceeds from green bonds were used to fund the energy sector globally.

All issuers are measuring tracking and reporting on the social and environmental impact of their investments. The green bond market can serve as an important bridge between providers of capital such as. GRESB GREEN BOND GUIDELINES Introduction The Green Bond Principles Principles provide the basis for capital market participants to originate Green Bonds.

Buildings was the second largest sector which. Other green bond issuers now include companies and banks of all sizes and several countries. We would welcome more green bonds from sectors such as capital goods healthcare and basic industries to enable greater diversification.

Green bonds could enable capital markets to support companies from these sectors in their transition to low carbon business models. Green bonds are now used globally as a financing source for a wide range of issuers including green renewable energy companies sovereigns and supranationals and brown corporate issuers seeking to transition some or all of their business. Green labelled bonds ie.

L The speed at which green bond markets develop and mature hinges on many variables including policy and regulatory factors market conditions and financing trends. Additionally the evolving green bond market faces a range of specific challenges and barriers to its further evolution and growth. Top 10 largest green bond issuers.

It is clear that the PBoCs Green Financial Bond Guidelines have filled a need in the domestic market by setting out procedures and requirements for financial bond issuers encouraging second opinions report and bond rating schemes. Absorb the increasing supply of green bonds. Fannie Mae is the largest issuer of green bonds by volume in a single year.

The Green Bond Endorsed Project Catalogue developed by the Green Finance Committee of the China Society of Finance and Banking is an important supplement to the guidelines setting out the boundaries of what is and is not considered green.

Drivers Of Green Bond Market Growth The Importance Of Nationally Determined Contributions To The Paris Agreement And Implications For Sustainability Sciencedirect

Http Pubdocs Worldbank Org En 554231525378003380 Publicationpensionfundservicegreenbonds201712 Rev Pdf

Green Bonds Growing In Europe Franklin Templeton

Transition Bonds Questions Of Transition Features Ipe

Http Pubdocs Worldbank Org En 554231525378003380 Publicationpensionfundservicegreenbonds201712 Rev Pdf

Http Pubdocs Worldbank Org En 554231525378003380 Publicationpensionfundservicegreenbonds201712 Rev Pdf

Corporate Green Bonds Sciencedirect

Income And Impact Adding Green Bonds To Investment Portfolios Brown Advisory

Http Pubdocs Worldbank Org En 554231525378003380 Publicationpensionfundservicegreenbonds201712 Rev Pdf

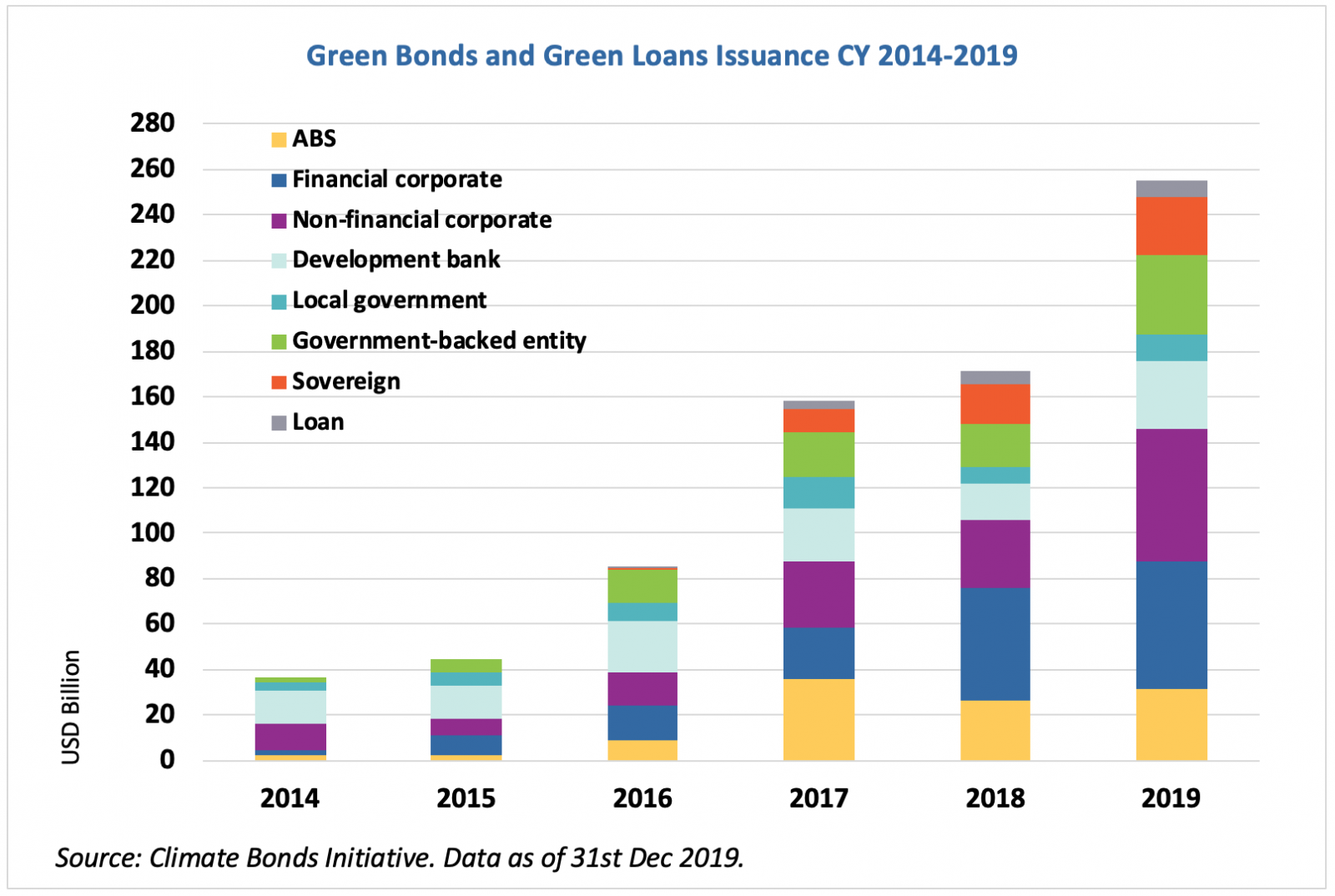

Green Bonds Reach Record 255bn For Cy 2019 New Milestone 350 400bn Climate Bonds Initial Forecast For 2020 1trillion In Annual Green Investment In Sight For Early 2020s Climate Bonds Initiative

Number Of Green Bonds Worldwide By Sector 2020 Statista

Http Pubdocs Worldbank Org En 554231525378003380 Publicationpensionfundservicegreenbonds201712 Rev Pdf

Certified Bonds Climate Bonds Initiative

Sustainability Free Full Text The Green Bonds Premium Puzzle The Role Of Issuer Characteristics And Third Party Verification Html

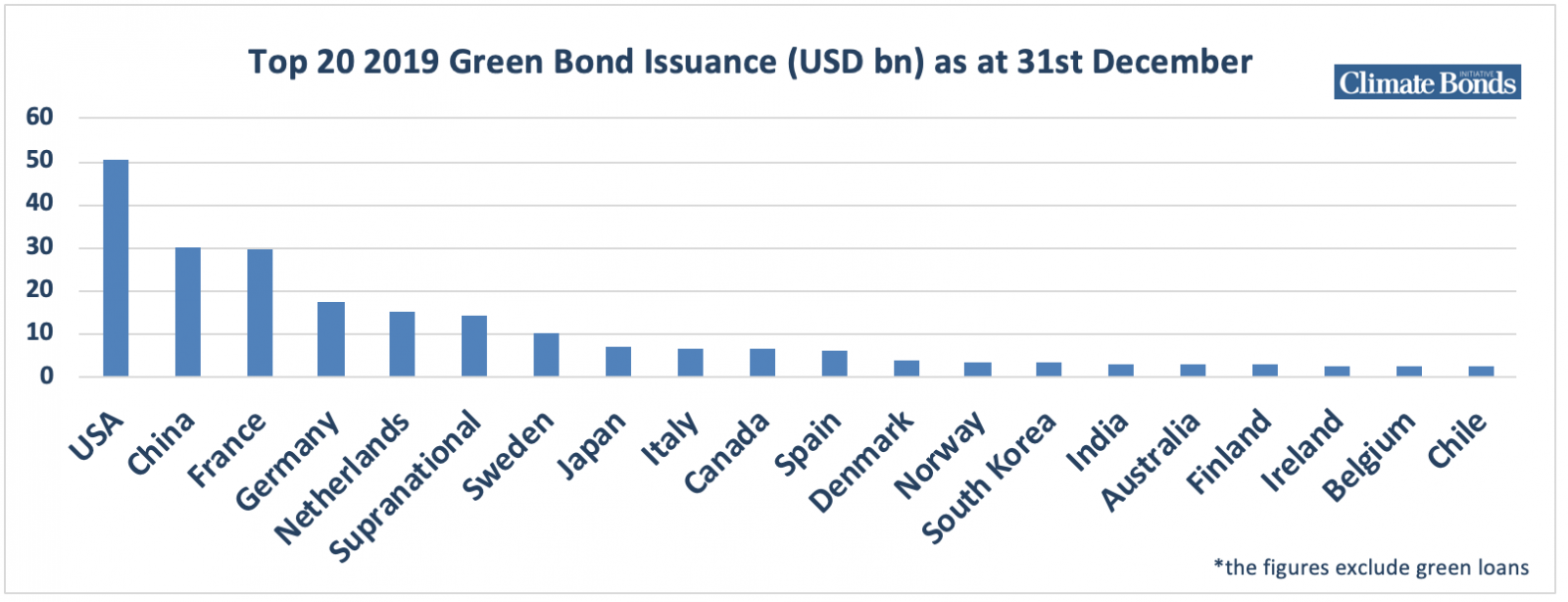

Green Bonds Reach Record 255bn For Cy 2019 New Milestone 350 400bn Climate Bonds Initial Forecast For 2020 1trillion In Annual Green Investment In Sight For Early 2020s Climate Bonds Initiative

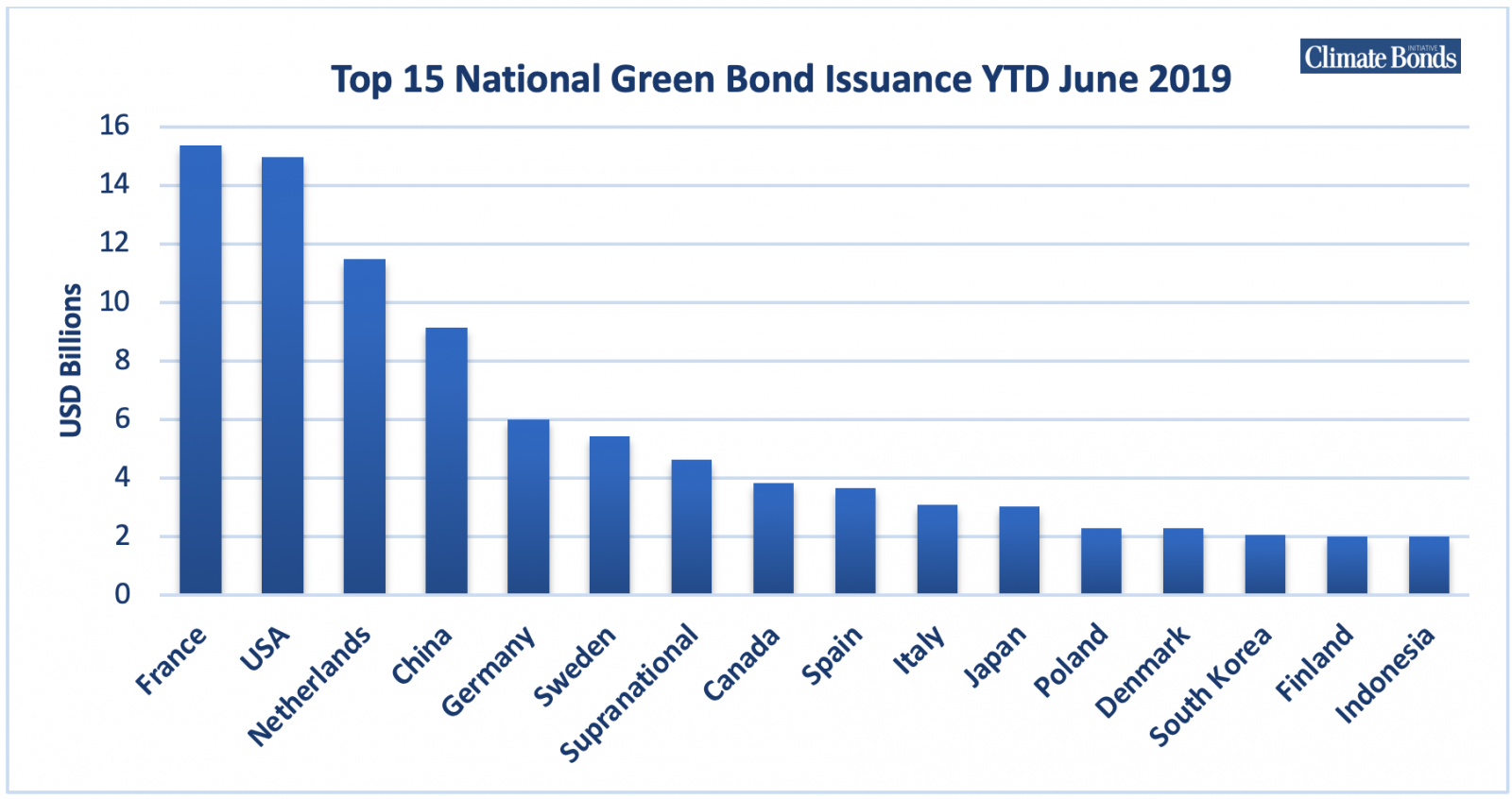

Green Issuance Surpasses 100 Billion Mark For 2019 First Time Milestone Is Reached In First Half Eu Teg To Open 2020 Pathways Towards 1trillion Climate Bonds Initiative

Green Bond Issuance By Issuer Europe 2019 Statista

Komentar

Posting Komentar